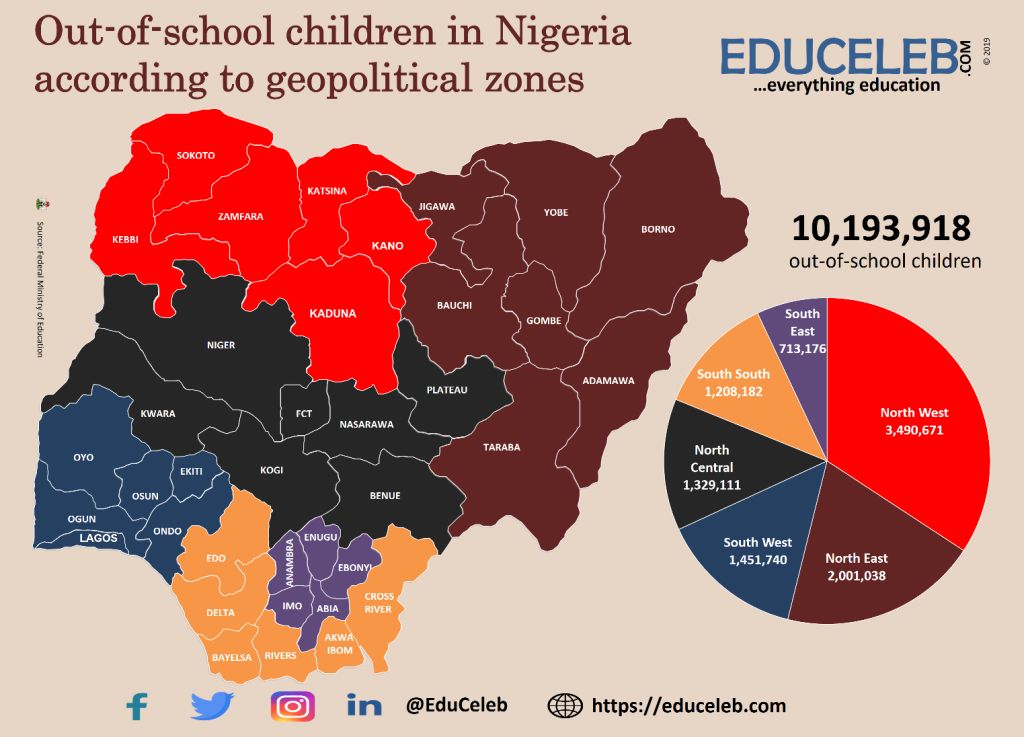

United Nations Children Funds (UNICEF) has said there are now 18.5 million out-of-School children in Nigeria. According to UNICEF, the figure is much higher compared…

According to UNICEF, the figure is much higher compared to the 2021 estimate put at 10.5 million.

PDP National Presidential Campaign Council set – Party official

Queen Elizabeth Under Medical Supervision as Health Concerns Grow

National Commission for Namadic Education (NCNE), Professor Bashir H. Usman, disclosed this at an orientation workshop for staff on strengthening the Capacity of Members of School Based Management Committees (SBMC) and Mothers’ Associations (MA) on combating Out-of-School Children in North West Geopolitical Zone in Nigeria held in Kaduna.

According to him, UNICEF also stated that 60 per cent of the out-of-school children are girls.

Bashir said it was estimated that of the 18.5 million out-of-the school children in the country, 3.5 million are from the nomadic background.

He said, “In this year 2022, UNICEF reported that Nigeria has 18.5 million children that are out of school. This figure is quite high when compared with 2021 estimates that was put at 10.5 million which puts Africa most populous country’s out-of-school children to be on an emergency frequency.

“Alarmingly, UNICEF posts that 60 per cent of the 18.5 million in Nigeria are girls. This could be worse in the North West zone comprising Jigawa, Kaduna, Katsina, Sokoto, Zamfara and Kebbi states which were adversely affected by kidnapping, banditry, insurgency and early marriage, hence the increased number of out-of-school children in the zone.

“The prevalence of out-of-school children could exacerbate the worsening security situation in the zone. It has been estimated that out of the 18.5 out-of-school children in Nigeria, 3.5 million children are from the nomadic background. Issue of our school children has been one of the major challenges in the implementation of Nomadic Education Programme (NEP) in Nigeria.”

The executive secretary also said that following NEP’s advocacy, enrollment increased from 594,230 in 2015 to 1,214,186 in 2022.

He also explained that there was an expansion in nomadic schools across the 36 states and Federal Capital Territory from 3,939 in 2015 to 4,375 in 2022.in his remarks, Director, Social Mobilization and Women Development, Dr. Fidelis Ugochukuwu Idoko, said insecurity in the Northwest increased among schoolchildren.

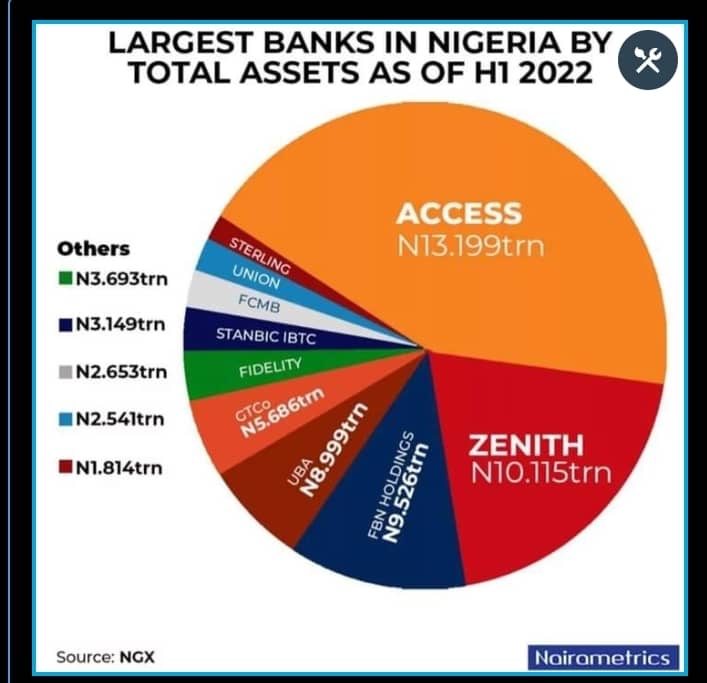

The top five banks in Nigeria by total assets are:

GTCO – N5.69 trillion

Guaranty Trust Holding Company Plc (GTCO) posted a total asset value of N5.69 trillion as of June 2022, which is 4.6% higher than the N5.44 trillion recorded as of December 2021. GTCO accounted for 8.9% of the total assets of the thirteen banks.

The banking giant, which also restructured into a holding company last year saw its cash and bank balances with the Central Bank rise to N1.04 trillion in June 2022 from N933.59 billion as of the end of last year.

Also, loans to customers increased marginally from N1.8 trillion as of December 2021 to N1.83 trillion by the end of June 2022. Meanwhile, financial assets at fair value through profit or loss improved significantly from N104.4 billion to N262.32 billion.

#4: UBA – N8.99 trillion

United Bank for Africa ranks fourth on the list of biggest banks in Nigeria based on total assets with a value of 8.99 trillion, representing a 5.4% increase from N8.54 trillion recorded by the beginning of the year.

UBA accounted for 14.2% of the total asset value of the entire thirteen banks on the list. A further breakdown of the bank’s statement of financial position showed that it’s cash and bank balances improved to N1.98 trillion from N1.82 trillion recorded as of the beginning of the year.

Also, its loans and advances to customers increased to N2.75 trillion from N2.68 trillion, while loans to banks improved to N198.1 billion as of the period under review. Property and equipment stood at N183.6 billion, while investment securities at fair value stood at N1.63 trillion.

3: FBN Holdings – N9.53 trillion

FBN Holdings posted a total asset valuation of N9.53 trillion as of June 2022, representing a 6.6% increase from N8.93 trillion recorded six months earlier. FBN Holdings, which is the parent company for First Bank accounted for 15% of the total aggregate assets for the thirteen banks.

FBN’s asset growth can be attributed to increasing in its cash and balances, loan books, and investment securities. Its cash and balances with Central Bank rose from N1.59 trillion to N1.64 trillion in the six months period.

Also, its loans and advances to customers improved from N2.88 trillion as of December 2021 to stand at N3.38 trillion by the end of June 2022. It is worth adding that its investment securities rose to N2.16 trillion from N1.96 trillion.

On the flip side, its property and equipment declined marginally to N113.79 billion from N115.9 billion recorded as of December 2021.

#2: Zenith Bank – N10.12 trillion

Zenith Bank reported a total asset value of N10.12 trillion as of June 2022, an increase of 7.1% from N9.45 trillion recorded as of December 31st, 2022. Zenith Bank accounted for 15.9% of the total assets of the banks listed on the Exchange.

The increase in its total assets was as a result of improvement in its cash and balance with the Central Bank, treasury bills, loans to customers as well as investment securities.

The bank, which is also the most capitalized bank in the Nigerian equities market, saw its loan books increase to N3.49 trillion as of June 2022 from N3.36 trillion, while investment securities stood at N1.48 trillion.

In the same vein, property and equipment improved, albeit only marginally from N200 billion to N202.3 billion. Investment securities improved from N1.3 trillion recorded as of the beginning of the year to N1.48 trillion by the end of June 2022.

#1: Access Bank – N13.19 trillion

Access Holdings Plc tops the list with a total asset value of N13.19 trillion as of June 2022, representing an increase of 12.5% compared to N11.73 trillion recorded as of the beginning of the year.

The financial institution, which is a newly restructured holding company accounted for 20.8% of the total assets of the thirteen banks under consideration. The uptick in the total asset value of the bank can be attributed to improvements in some of the asset components, especially loans and advances.

Specifically, loans and advances to customers rose to N4.62 trillion as of the period under consideration from N4.16 trillion recorded as of the beginning of the year. This means that Access Bank gave out an additional N458.2 billion in loans to its customers in the first six months of the year.

Also, investment securities rose by N493.6 billion to stand at N2.76 trillion. The value of its property and equipment increased to N261.8 billion from N247.7 billion, having spent N36.7 billion on the acquisition of property and equipment in the same period.

Meanwhile, Access Bank has entered into a binding agreement with Centum Investment Company Plc to acquire its entire 83.4% equity stake held by Centum in Sidian Bank Limited.

Also, the holding company received regulatory approval in August 2022 to acquire a majority equity stake in First Guarantee Pension Limited, in a bid to evolve into a financial service holding company.

Others include

Fidelity Bank – N3.69 trillion

Stanbic IBTC – N3.15 trillion

FCMB – N2.65 trillion

Union Bank – N2.54 trillion

Sterling Bank – N1.81 trillion

Categories: Financial Services, Metrics, Rankings

Tags: Featured

Leave a Comment

Nairametrics

Back to top

According to a letter dated 5th May 2023 signed by the Chairman of the Governing Council of the Polytechnic Senator Muhammed A. Muhammed conveying the appointment states that the appointment is for a single term of five (5) years and is not renewable in line with the Federal Polytechnics (Amendment Act) 2019.

Dr. Tanimu until his appointment as the Registrar of the Federal Government-owned Kaduna Polytechnic is a Deputy Registrar in the Registry Department of Nasarawa State University and the Faculty Officer, Faculty of Administration.

The newly appointed Registrar is a Member of the Association of Nigerian University Professional Administator, MANUPA, Associate Member, Institute of Management Consultants (AMIMC), Associate Member, Nigeria Institute of Management (AMNIM), & Associate Fellow, Institute of Corporate Administration (AFICA).

Dr. Tanimu with this appointment joins the growing league of NSUK exports who are excelling in various fields of endeavors in the Nigerian Tertiary Education sector and carries with him a rich resumé of industry experience.

Hi lovers 🤩

My name is Mubarak and i made different types of caps.

Custom caps are a type of hat that is made to order by an individual or company. They can be customized in many different ways, from the caps themselves to the fabric and embroidery used for embellishments. You can also customize them by adding designs or logos, as well as personalizing them with whatever colours and styles you want.

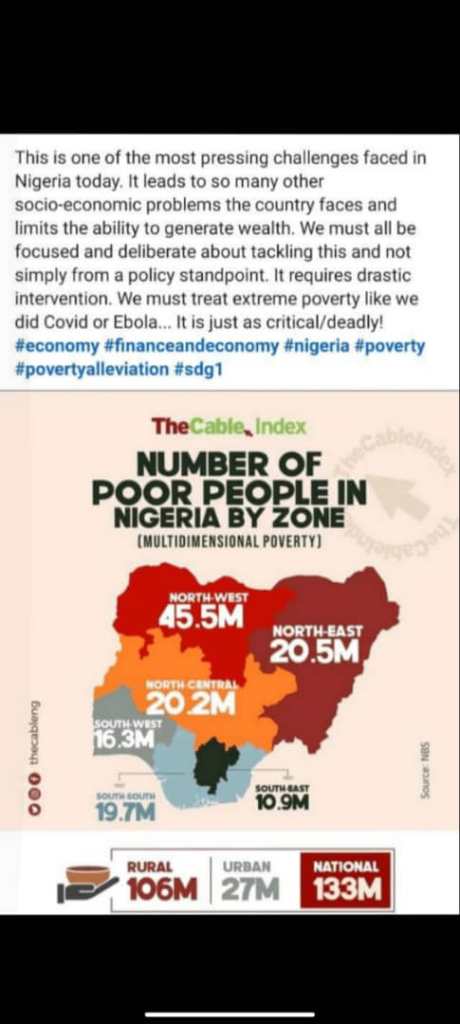

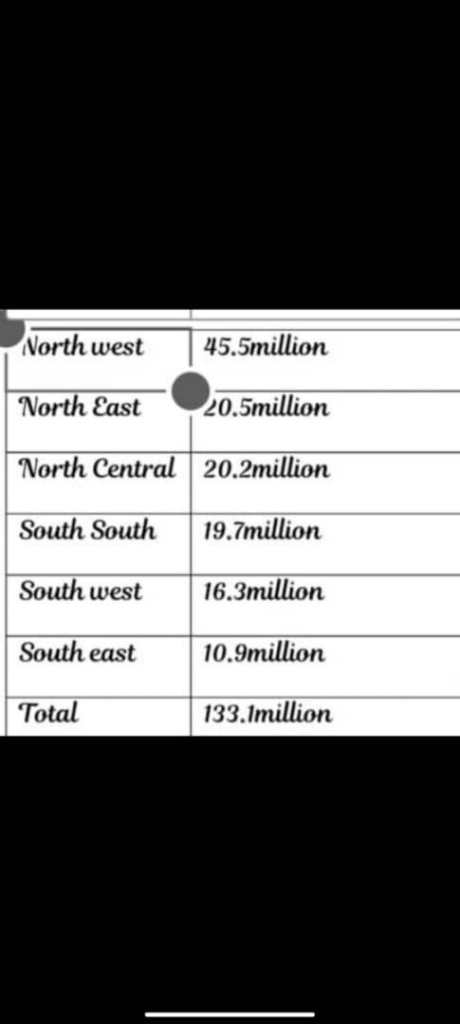

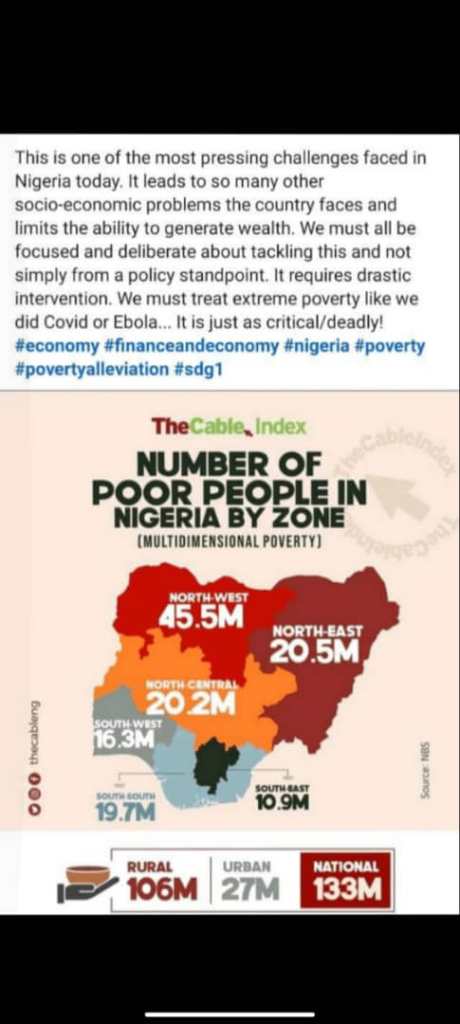

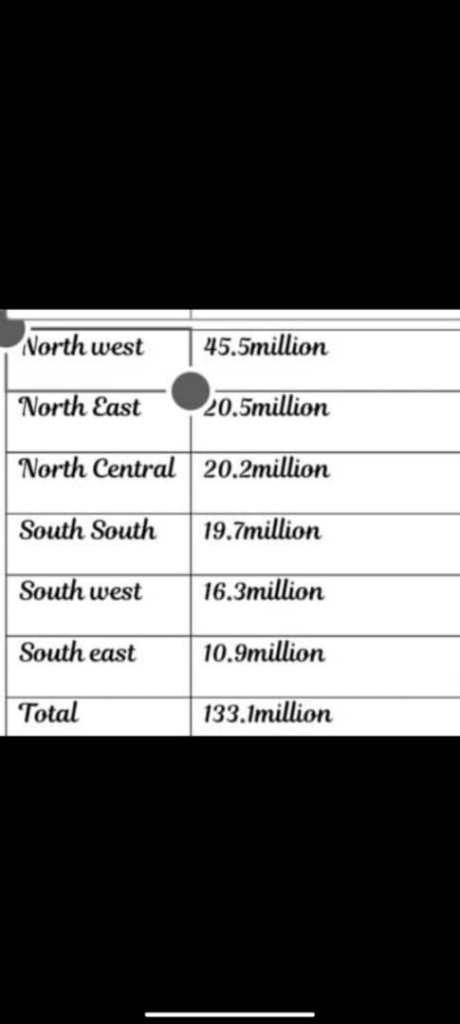

Sokoto, Bayelsa, and Jigawa States led the list of states in Nigeria with the highest multidimensional poverty index, having an aggregate of 14.18 million impoverished people.

Factors such as healthcare, food insecurity, education, nutrition, and access to cooking fuel contributed the most to the national poverty index. According to the NBS, over half of the Nigerian populace is multidimensionally poor and deprived of cooking fuel.

The highlights: 65% of the poor people in Nigeria, which translates to 86 million live in the Northern part of the country, while 35% (47 million) live in the southern part.

The National Bureau of Statistics (NBS) recently released the highly anticipated multidimensional poverty report. The report put Nigeria’s poverty index at 0.257, with about 133 million people being multidimensionally poor.

September 16 2023 kaduna polytechnic had a world cleaning day in school premises and Hostel premises

SUG member cleaning and keeping kadpoly female hostel clean .Female hostel was swept and dirty was packed and cleaned by the SUG members

The Team was led by deen student Affair MAL FAROQ .N. MUSA and SUG President Mr MANGAL other Sug Excos were present and the cleaning was done well .

Kadpoly sanitation was not just done in Female hostels but also in Male Hostels and school environment . all promises were cleaned and cleared and everywhere was kept clean